E&P | Elaine Maslin | July 30, 2018

Some 74% of the estimated 3.9 billion barrels of oil equivalent (Bboe) discovered in first-half (1H) 2018 was in ultra-deep water, despite onshore drilling accounting for 57% of the exploration well count, according to analysts at Wood Mackenzie.

Deep and ultra-deepwater accounted for just 16% of the total exploration well count.

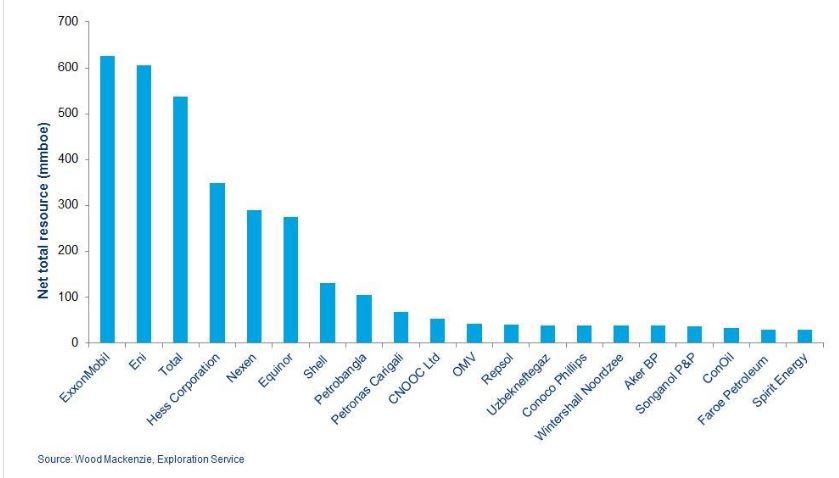

Oil majors are leading the charge in part driven by investors wanting to see growth. Exxon Mobil Corp. made the most discoveries in terms of volume in 1H 2018, trailed by Eni, Total, Hess Corp., Nexen, Equinor and Shell. These companies were followed by state-owned Petrobangla, Petronas and CNOOC.

“The oil major’s market share of high-impact exploration is as high as I can remember it,” said Andrew Latham, vice president, research, global exploration, for Wood Mackenzie. “There’s no doubt that the cost environment has made the market more favorable toward deep water, which is now very often more favorable than shale plays, with a sweet spot at US$40/bbl or less.

“That sweet spot is high-quality reservoirs able to deliver 20 million barrels [MMbbl] per development well to keep costs down. Some of the gas finds are above 1 Tcf per development well, so their break-evens are even lower,” Latham continued. “The operators are also looking for places where there is a route to market. It sounds obvious, but when oil was $100/bbl, this kind of discipline was not quite there; there was something of a scattergun approach.”

A targeted approach is paying off for some.

Deepwater Finds

The average discovered volume for an ultra-deepwater well in the first half was just shy of 140 million barrels of oil equivalent (MMboe), compared with less than 25 MMboe for onshore wells, according to data on Wood Mackenzie’s 2018 Wildcat Wells to Watch, compiled by Wood Mackenzie Research Analyst Alex Connelly.

A significant portion of those volumes came from the two largest discoveries in 1H, both of which sit in newly discovered plays. The largest is Eni’s ultra-deepwater Calypso discovery offshore Cyprus, containing between 6 trillion cubic feet (Tcf) and 8 Tcf (1.1 billion boe) of gas, in 1,047 m water depth.

The second largest is ExxonMobil’s Ranger at 500 MMboe. Ranger is one of three discoveries, alongside Longtail and Pacora, made this year by Exxon Mobil in the Stabroek Block, taking the total recoverable resource estimate for the block to 4 billion, according to partner Hess Corp. Ranger marks a new play in the block, proving the carbonate, Latham noted.

Other notable deepwater finds include Boudji and Ivela, offshore Gabon, discovered by Repsol and Petronas, respectively. They are the first discoveries in that part of deepwater offshore Gabon; however, despite being in seventh and 12th place in the 1H biggest finds rankings, respectively, they may not be commercial, Latham said.

Read the full story here.