Offshore Technology | Talal Husseini | August 3, 2018

As oil prices tentatively recover from the 2014 crash and investments in alternative renewable energy sources gain momentum, oil and gas companies need to innovate to stay competitive and keep the fuel flowing. Offshore Technology asks industry experts for their insight into how technological advancements will shape the future of oil and gas.

Industry experts give their opinion on what is likely to shape the future of oil and gas. Credit: Lenn Mayhew Lewis.

The future of oil and gas: ‘Smart drilling’

Nowadays, it seems like more and more companies want to become the Carl Lewis or Usain Bolt of drilling. Get out the blocks fast, hit every stride sweetly and cross the finish line to first oil in record time.

As any elite runner will tell you, the equipment alone doesn’t win you the race. Equally, if not more important, is developing a race plan, road-testing that plan, and developing the intelligence to know exactly when, where and how to hit the gas.

So when it comes to the future of the oil and gas industry, ‘smart drilling’ will be key and require a combination of technology and thinking that reimagines how firms manage and execute a more harmonised approach to early well life.

The key is ensuring that design, analysis, equipment selection and implementation are all aligned and buttressed by operational expertise. Where companies lack the expertise or resource, initiation specialists will fill the void.

As drilling projects grow in ambition, smarter equals faster. By combining integration and intelligence through specialist providers in the initiation phase with best-in-class technology, ‘smart drilling’ promises to give projects the solid footing needed to keep the industry running for decades to come.

– James Larnder, managing director, Aquaterra Energy

The future of oil and gas: Incorporating blockchain

One technology set to transform the oil and gas sector is blockchain. In fact, the blockchain revolution is starting here and now. The real task for the oil and gas sector is how quickly it can move to take advantage of the many opportunities that blockchain will bring.

For oil and gas businesses, data has gone from an asset to a burden. Companies are drowning in data and urgently need a way to control and authenticate information. Blockchain has enormous potential to reduce the risk of fraud, error, and invalid transactions in energy trading, make financial transactions more efficient, facilitate regulatory reporting requirements, and enable interoperability.

Blockchain will have huge benefits both upstream and downstream. From scheduling equipment maintenance to managing exploration acreage records, blockchain offers a single, unalterable record of transactions and documentation between numerous parties. Distributed ledgers also create more efficient and transparent downstream activities, such as exchanging products, secondary distribution delivery documentation, demurrage, and claims management. Mid-stream, it will revolutionise joint ventures, risk management, contracting, and regulatory compliance.

The possibilities of blockchain in oil and gas have few limits – and we’re yet to see more than a glimpse of its full capabilities.

– Simon Tucker, Head of Energy and Commodities, Infosys Consulting

The energy sector is seen as the next frontier for blockchain development outside the financial sector, where the distributed ledger technology has had its biggest impact to date. Blockchain is critical to unlocking the efficiency potential of distributed energy generation and disintermediating the public and private utility companies. So too does blockchain open up efficient fundraising through initial coin offerings (ICO’s).

More than 1,500 ICOs have taken place in the energy space over the last two or three years. Admittedly, a disproportionate number of these token offerings have been electricity or renewables-focused, but the number of token offerings in the traditionally technologically phobic oil and gas sector is now rising.

Read the full story here.

News & Observer

News & Observer

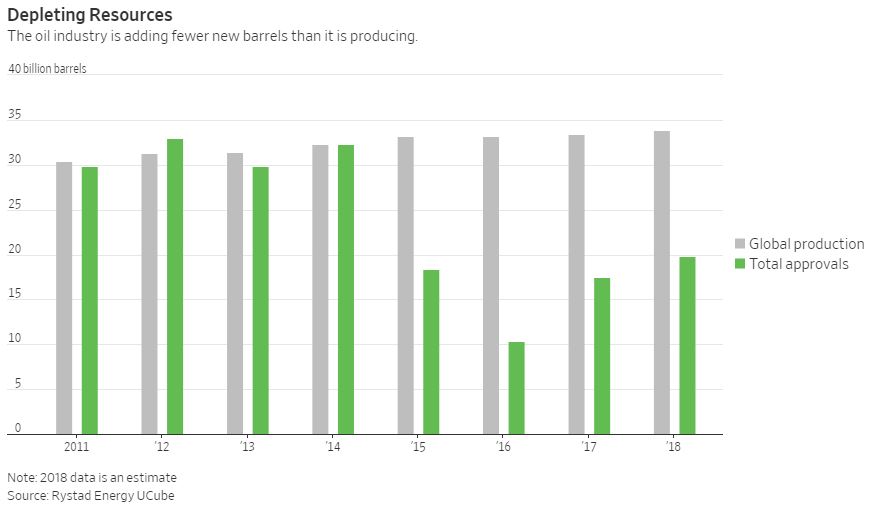

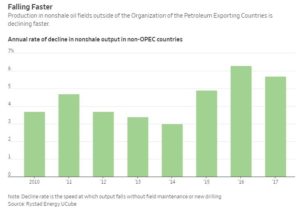

Any shortfall in supply could push prices higher, similar to when oil hit nearly $150 a barrel in 2008, some industry participants say.

Any shortfall in supply could push prices higher, similar to when oil hit nearly $150 a barrel in 2008, some industry participants say.